In a highly anticipated decision the Washington Supreme Court upheld the new state capital gains tax which is due next month.

The controversial tax was challenged on constitutional grounds by multiple plaintiffs who argued that it represents an unconstitutional income tax. The 2021 bill that created the tax explicitly described it as an excise tax on the sale or exchange of certain capital assets.

Last year a superior court judge ruled the tax unconstitutional, but with a 7 to 2 ruling on March 24, the state supreme court reversed that decision.

The majority opinion, written by Justice Debra Stephens, concluded:

“The capital gains tax is a valid excise tax under Washington law. Because it is not a property tax, it is not subject to the uniformity and levy requirements of article VII, sections 1 and 2 of the Washington Constitution.”

In the dissenting opinion Justice Sheryl Gordon McCloud wrote:

“A tax is determined by its incidents, not by its legislative label. The structure of the capital gains tax shows that it is a tax on income resulting from certain transactions—not a tax on a transaction per se. Therefore, the tax is an income tax, not an excise tax. Under our constitution and case law, an income tax is a property tax. As enacted, this income tax or “capital gains tax” violates the one percent levy limitation of article VII, section 2.”

The state capital gains tax is a 7% tax on long-term capital gains, referring to the sale or exchange of assets held for one year or longer. It applies to the sale of long-term investments above $250,000 such as stocks, bonds, cryptocurrency, and other assets. The tax applies to individuals, married couples, and domestic partners. It does not apply to corporations.

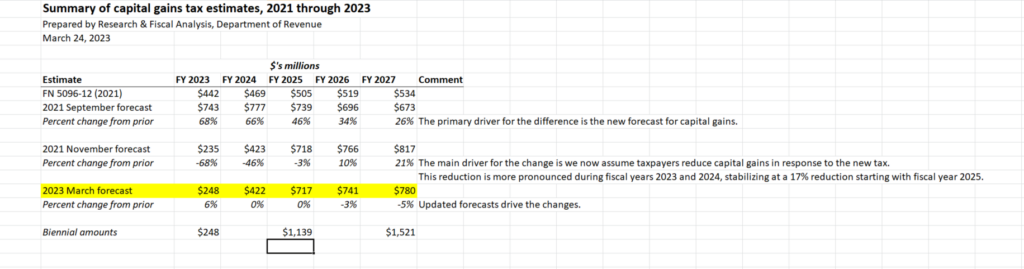

According to the state Department of Revenue, the first payments are due on or before April 18, 2023. The tax is now projected to bring in about $3 billion over the next five years, jumping from $248 million in FY 2023 to $780 million in FY 2027.

There are a number of exemptions to the capital gains tax including:

- Real Estate

- Certain retirement accounts

- Timber

- Certain livestock

- Depreciable business assets

There’s also a standard deduction of the first $250,000 of capital gains per year per individual, married couple, or domestic partnership (adjusted for inflation annually).

The sale of a qualified family-owned small business that has no more than $10 million in gross worldwide receipts in the prior 12 months is exempt from the tax.

There is also an exemption for up to $100,000 for very large charitable donations above $250,000.

The state supreme court ruling comes less than a month after the first capital gains tax payments are due.

Progressive organizations around Washington are celebrating the ruling.

The Washington State Budget and Policy Center was heavily involved in the push to change the state’s tax structure through ESSB 5096.

“We had a decisive 7 – 2 ruling upholding an equitable new excise tax on extreme stock profits from the wealthiest Washingtonians. This is going to make a big difference in a lot of people’s lives. The tax is going to generate $500 million in new funding for child care, early learning schools, things that are sorely needed in communities across the state. And it’s going to be a really meaningful step toward rebalancing Washington’s notoriously upside down tax code,” said Andy Nicholas, a Senior Fellow with the Washington State Budget and Policy Center.

Some of the most prominent criticism of the capital gains tax has come from the free-market focused Washington Policy Center.

“The rates could change. They could take that $250,000 exclusion and drop it down. And there already was a bill to drop it down as low as $15,000 this year. So this tax that becomes only on the wealthy becomes much more on everyone who has sold stock and made over $15,000. That’s the nature of these taxes. Once they’re in, the ratchet gets turned down. Also, there’s the notion of changing the exclusion amount, which right now is $250,000. So those the tax can be tuned. It’s also a concern that this could be applied to the same theory that was approved by the court, could be applied to the real estate excise tax, that you could start taxing gains on personal real estate,” said Mike Gallagher, President and CEO of the Washington Policy Center.